Berachain as a project is simply on fire!!!

Testnet down, Faucets crashing, and Discord server overload. Degens just can’t get enough of it.

So today, as part of our “Project Handbook” we will cover the Berachain ecosystem projects in the coming weeks.

To kick-off, we will be starting with Beradome

We will take a look at it from the PoV of a project study and answer some questions that took a while for us to research.

What is Beradome?

Restaking platform built on Berachain.

Beradome aims to bring a liquidity market to the Berachain ecosystem by allowing users to leverage their $BGT tokens within a more powerful DeFi offering.

Through this approach, Beradome maximises the earning potential for BGT holders using a 3-token structure of iBGT, BERO & hiBERO

🔸Testnet

There is just a website: beradome.com with a static logo of the project.

There is no hint of the product, upcoming features, tentative launch ETA or even links to socials of the projects.

Their testnet V1 was live and they are building for V2 and it seems V1 is no longer accessible to new entrants.

My assessment here is that Beradome wants to focus on first building its community before launching a working product in the Bera ecosystem. Which is think is fair!

Tokenomics

The official tokenomics docs clearly states that the inspiration for Beradome tooenomics has been taken from Solidly system.

However they changed every aspect keeping in mind their BERO token and is not a copy+paste. Additionally, they have also added few newer aspects like Floor Price and Borrowing against Voting token.

For further clarity, Beradome also adds info on their bonding curve mechanism and how it translates to offering features such as, Token-owned Liquidity amongst others!

🔹Whitepaper and docs

The doc for the project is quite satisfactory if not great. They have outlined pretty much the stuff on which Beradome will be operating on and how the product will function for the end-user.

It also clearly mentions the role oBERO & hiBERO will be playing in the flywheel. Happy to see an AUDIT section already as a placeholder in the Beradome docs, shows that they are serious about what they are doing and will publish their audit report for public scrutiny when that happens. Link to docs:

https://docs.beradrome.com/

🔸Project backers

There is no mention of any VC or funds investing. But according to my thesis, the project might have some sort of support from BERACHAIN Foundation, but that’s just me guessing.

🔹Product-market fit and competitive landscape

The PMF here is absolutely on point.

Restaking and Liquidity pools have gained massive traction in the past few months because of the entire Celestia narrative.

Users are now willing to make their assets work in the DeFi space and maximise their yield on-chain, rather than leave assets lying on a CEX like dumb money.

Berachain has the most visibility and hype in terms of projects on testnet and having a restaking tool even before the main ecosystem goes mainnet is ready to face a massive explosion in TVL within the DeFi ecosystem of Berachain.

🔸Business model and project revenue

Honestly not sure about the revenue model, since there is no clarity on the MAU, TVL, competitive landscape in the Berachain DeFi ecosystem, and total assets locked.

It is very hard to come to a definitive conclusion at the present moment.

But their Tour de Berance NFTs are great and unlocks perks and roles on discord, plus the fact that OG NFTs of the Berachain are 60 ETH floor price, the community would see the Beradome NFT collection as a much more valuable proposition.

Talking with a PvP mindset here.

Link to Tour de Berance NFT collection: https://opensea.io/collection/tour-de-berance

🔹Project Development

There is a lot to be achieved here, but keeping in mind that Berachain has not gone live on the mainnet, we have to wait for Beradome’s play.

Some chains have been on mainnet for almost 2 years and their DeFi protocols are still laggy, so Beradome has to be given proper time to assess its 0-1 potential.

Plus improvement can happen only on a working product and Beradome should either pave out a community roadmap or hint about what their testnet play might be.

Too early to conclude, but it seems the focus will only be on BGT which is native berachain.

So I believe Beradome will a chain-exclusive and will only focus on the Berachain ecosystem. Their recently published flywheel is a great example of the same.

🔸Partnerships established inside and outside the Berachain ecosystem

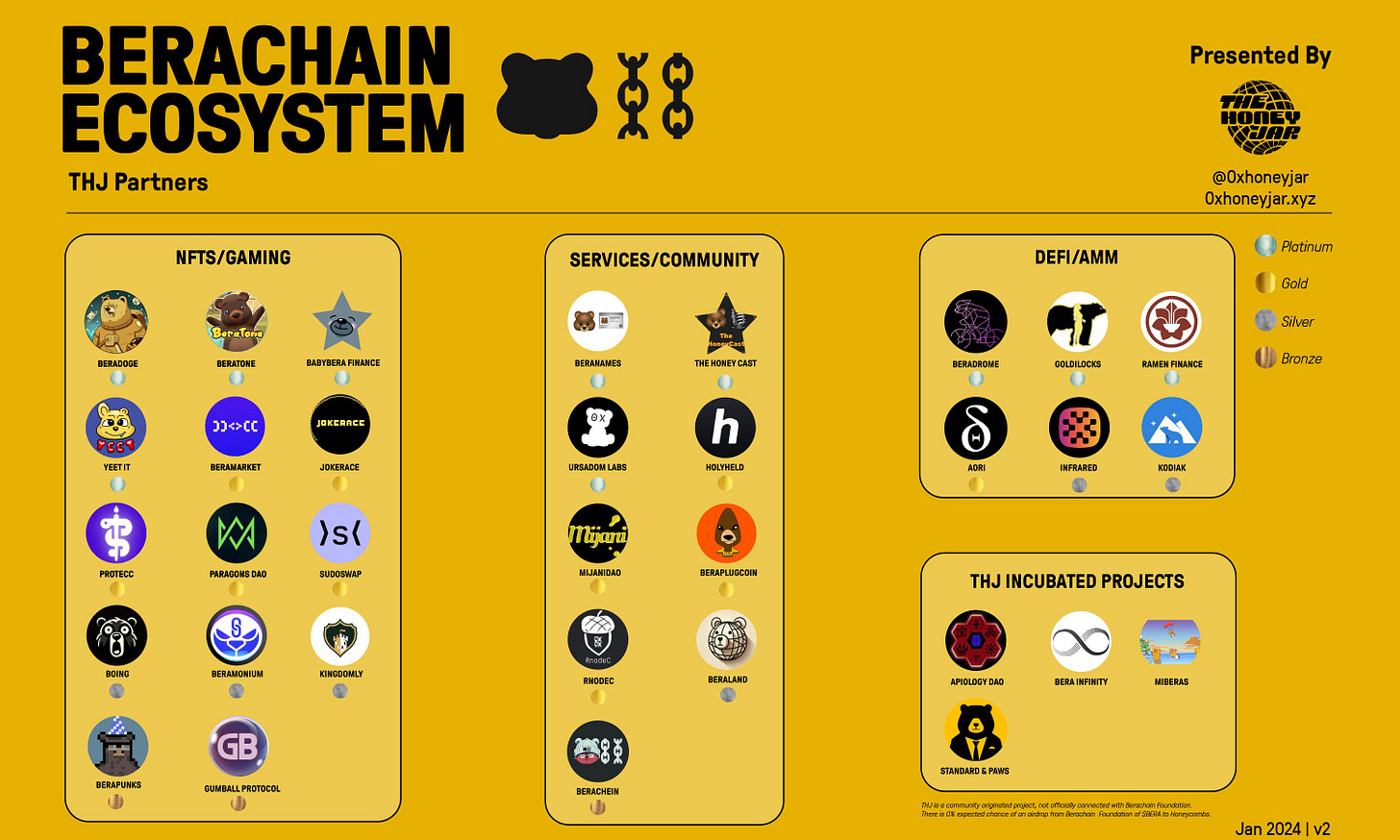

The Honey Jar (THJ) a community-originated project on Berachain and has shared a Deal Sheet which was co-signed by Beradome.

The deal sheet publicly states that Honeycomb holders will receive 0.7% of the $hiBERO token.

🔹How strong is the project vibe?

Anything coming out of the Berachain ecosystem is going to gain massive community traction.

Community is super hyped on Bera and every project associated with Berchain is seeing massive organic growth, Quests, Testnet, Discord, Twitter growth are all through the roof.

Beradome has the Berachain ecosystem narrative plus the retaking hype will give it the much-needed snowball effect.

🐻⛓️ Conclusion

Berachain and its ecosystem projects, exemplified by Beradome, are igniting a wildfire of excitement in the DeFi space.

Despite the testnet challenges and the frenzy of the community, Beradome stands poised to revolutionize liquidity markets within the Berachain ecosystem.

With a robust tokenomics model, a clear vision outlined in its documentation, and strong community support, Beradome is primed for success.

As we eagerly anticipate its evolution, one thing remains certain: within the Berachain narrative, Beradome is positioned to thrive and lead the charge towards a new era of DeFi on what is the most anticipated chain in the crypto wild-west.